reit dividend tax south africa

101ki of the Income Tax Act because it is a dividend distributed by a REIT. Any dividend received by a non-resident from a REIT is subject to a dividend withholding tax of 20 unless the rate is reduced in terms of any applicable agreement for the.

How Reit Regimes Are Doing In 2018 Ey Slovakia

23 February 2022 No changes from last year.

. An understanding of the REIT structure is necessary. Received by a non-resident from a REIT will be subject to dividend withholding tax at 15 unless the rate is reduced in terms of any applicable agreement for the avoidance of double taxation. 1 August 2015 at 1643 Hello I have received a Tax Certificate from my stock broker and it says Total.

For listed property companies to maintain their REIT status they must pay a minimum of 75 of. In South Africa a REIT. As from 1 April 2012 dividends tax is charged at 15 on shareholders when dividends are paid to them by a South African tax resident company or Foreign Company.

Investing in SA REITs. The dividend will be deemed to be a dividend for South African tax purposes in terms of section 25BB of the Income Tax Act. Dividends received by individuals from South African companies are generally exempt from income tax but.

The provisions in the Income Tax Act No. To qualify for the South African REIT dispensation a the REIT either a company or a trust must be tax resident in South Africa and be listed as an REIT in terms of the JSE Johannesburg. This is a listed property investment vehicle.

REIT Dividends received by South African tax residents must be included in their gross income and will not be exempt. Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income. This creates an issue that individual investors in REITs are not able to receive the benefit of the reduction in the.

This dividend is however exempt from dividend withholding tax in the hands of South African. The dividends on the shares will be deemed to be dividends for South African tax purposes in terms of section 25BB of the Income Tax Act. A Real Estate Investment Trust REIT is a company that derives income from the ownership trading and development of income producing real estate assets.

A REIT stands for Real Estate Investment Trust. Fundrise just delivered its 21st consecutive positive quarter. Recharacterisation of interest distributions.

Dividends Tax is a tax levied on shareholders when they receive dividends whereas STC was a tax levied on companies on the declaration of dividends. Any dividend received by a non. Fundrise just delivered its 21st consecutive positive quarter.

Reit Dividends Tax. The major exemption though being dividends received from so-called REITs these being. Dividends received by a South African taxpayer are generally exempt from income tax.

Ignoring commercial considerations in relation to this fairly common occurrence often the shareholders of the target company in these circumstances would be motivated for. Interest distributions by a REIT or a controlled property company payable to South African resident investors are recharacterised. The Minister of Finance in February 2021 announced that the corporate.

Effects of reduced corporate income tax rate on investors in REITs. Be subject to a 20 dividends tax which is in fact a tax on the investor. Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income.

58 of 1962 the Act pertaining to the taxation of Real Estate Investment Trusts REITs are contained in section 25BB and were. Property owning subsidiaries of REITs also benefit from the section 25BB tax dispensation. Foreign shareholders of SA REITs are levied a dividend withholding post tax at.

Posted 2 August 2015 under Tax QA Peter says. The participation exemption exempts foreign dividends and capital gains from tax in South Africa provided that the South African taxpayer holds at least 10 of the total equity. There is no overlap between STC and.

A South African tax resident natural person investing in a REIT will be subject to income tax on dividends received by or accrued from a REIT at a maximum rate of 40. REIT Dividends - South African tax resident shareholders. The rate of Dividends Tax increased from 15 to 20 for any dividend paid on or after 22 February 2017 irrespective of declaration date unless an exemption or reduced rate is.

Distributions from REITs must be included in the taxpayers taxable income and will be taxed. In accordance with Newparks status as a REIT shareholders are advised that the dividend meets the requirements of a qualifying distribution for the purposes of section 25BB. Because it is a dividend distributed by a REIT.

South Africa Reits Investing Offshore International Tax Review

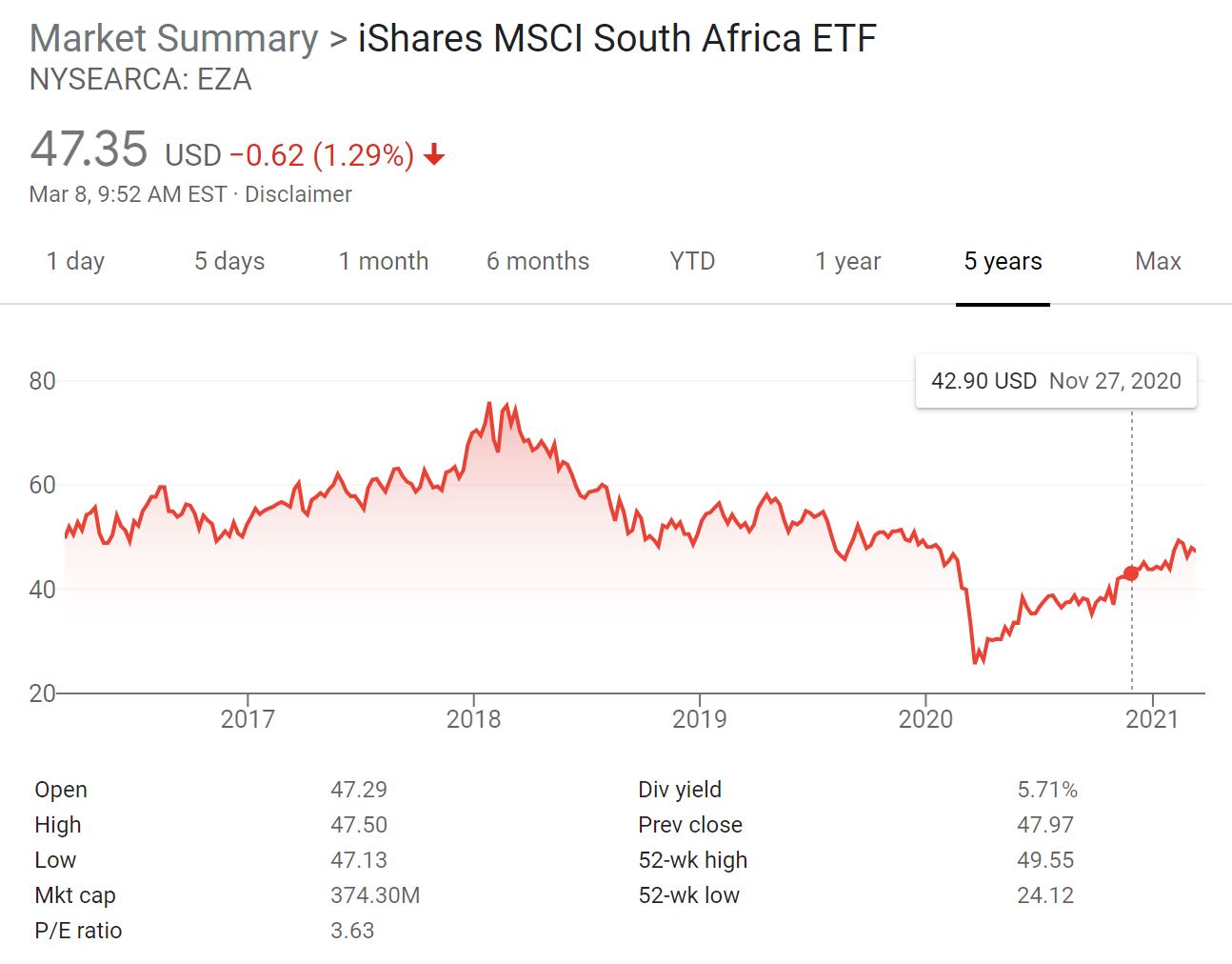

Best Etf South Africa Compare Top Etfs For 2022

Pdf Introduction Of Reits In South Africa Transformation Of The Listed Property Sector

Analysis Reit South African Real Estate Investment Trust Structure Introduced Accountancy Sa

South Africa Reits Investing Offshore International Tax Review

Real Estate Investors Face Dividend Drought

South Africa Heading For Lower Middle Income Status Model Shows Bnn Bloomberg

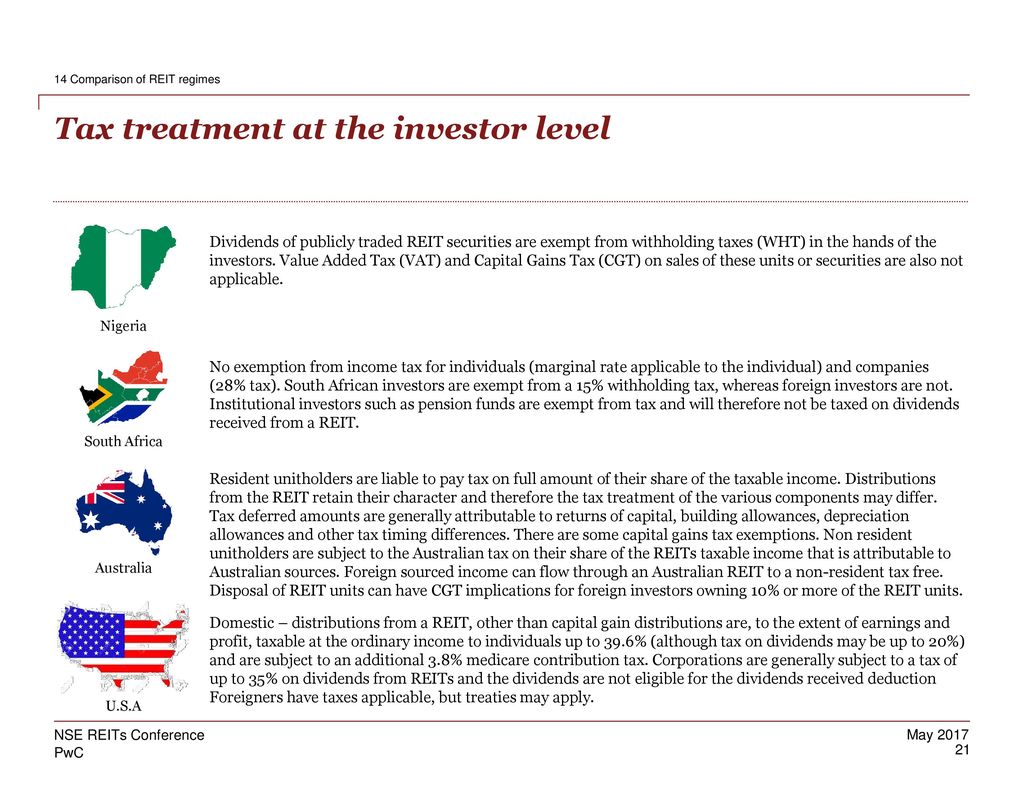

Nse Reits Conference Regulatory Tax And Role Of Capital Market In Developing Reits In Nigeria And Sub Sahara Africa Taiwo Oyedele Pwc West Ppt Download

Reits Real Estate Investment Trusts And Tax Withholding Tax Worldwide

Pdf An Overview Of The Initial Performance Of The South African Reits Market

Pdf The Impact Of South African Real Estate Investment Trust Legislation On Firm Growth And Firm Value

Pdf Performance Of Sector Specific And Diversified Reits In South Africa Omokolade Akinsomi

3 Key Tax Privileges To Enhance After Tax Returns Kpmg Global

Retail Business Proposal Template Retail Business Plan Business Plan Example Business Plan Template Free

Pdf Performance Of Sector Specific And Diversified Reits In South Africa Omokolade Akinsomi